Understanding Your Deposit

This guide walks you through the complete SynthOS experience, from connecting your wallet to managing your yield positions.

Phase 1: Setup (One-Time)

Step 1: Connect Your Wallet

Two ways to connect:

Option A: Social Login (Recommended for Beginners)

- Sign in with Google, Apple, or email

- Creates an embedded wallet automatically

- Gas fees sponsored for initial transactions

- No browser extension needed

Option B: EOA Wallet (For Experienced Users)

- Connect MetaMask, WalletConnect, or other Web3 wallets

- Use your existing wallet and addresses

- You manage your own gas fees

- Full control over private keys

What happens next:

- SynthOS creates a smart wallet for you on Scroll

- This smart wallet will hold your vault and execute transactions

- Your login wallet is just for signing - funds live in the smart wallet

Step 2: AI Analyzes Your Activity

Once connected, the AI immediately begins analyzing:

What it scans:

- Last 30-90 days of transaction history

- Protocols you've interacted with across DeFi

- Types of strategies you've used (lending, LP, staking)

- Average position sizes and hold durations

- Chains you're most active on

Analysis time: 2-3 minutes for comprehensive profile

Your DeFi Profile includes:

- Experience Level: Beginner, Intermediate, or Advanced

- Risk Tolerance: Conservative, Balanced, or Aggressive

- Preferred Chains: Which networks you use most

- Strategy Preferences: Lending, liquidity provision, staking, etc.

New wallet? If you have no DeFi history, AI defaults to conservative recommendations. As you use SynthOS, it learns your preferences.

Step 3: Create Your Personal Vault

What is a vault? When you create a User Vault, you're not making a new wallet - you're creating a personal smart contract that SynthOS uses to manage your yield strategies.

Why you need a vault:

- Your wallet can't track strategies or manage cross-chain deposits

- The vault keeps all your positions in one place

- It updates automatically when deposits/withdrawals complete

- It can be upgraded over time without affecting your wallet

Key properties:

- One vault per user on Scroll (your "home base")

- Non-custodial: Only you control deposits/withdrawals

- Beacon proxy pattern: Gas-efficient upgrades without changing your address

- Cross-chain tracking: Monitors positions on Arbitrum, Base, Optimism, etc.

Gas cost: ~$0.05-0.10 on Scroll (one-time fee)

Phase 2: Depositing & Allocating

Step 4: Deposit Base Assets to Your Vault

What to deposit:

- USDC: Main asset for yield strategies

- ETH: For gas fees on transactions

How much ETH?

- Minimum: ~$5 worth for gas fees

- Recommended: ~$10-20 for multiple transactions

- ETH stays in your smart wallet for gas, not in the vault

How much USDC?

- Minimum varies by strategy (typically $10-100)

- Start small to test the system

- You can deposit more anytime

Deposit methods:

- From your EOA wallet: Transfer from MetaMask or other wallet

- From another chain: Bridge from Arbitrum, Base, etc.

- Swap from other tokens: Convert ETH, USDT, etc. to USDC

Important: Assets deposited to your vault are idle (earning 0% yield) until you allocate them to strategies. Think of your vault as a staging area.

Step 5: View AI-Recommended Strategies

After depositing, the AI shows you personalized yield opportunities:

What you'll see:

- Yield Bundles: Diversified portfolios of multiple strategies

- Single Strategies: Individual yield opportunities

- Risk levels: Stable, Balanced, or Growth

- Current APY: Updated hourly

- Protocol details: Aave, Morpho, Compound, etc.

- Target chain: Where the yield is generated

Filter options:

- By risk level (Stable/Balanced/Growth)

- By protocol (Aave, Morpho, etc.)

- By chain (Arbitrum, Base, Optimism)

- AI Recommended only

Step 6: Choose a Strategy

Option A: Invest in a Yield Bundle

What is a bundle? A curated portfolio of multiple strategies grouped by risk level:

- Stable Bundle: 3-5 low-risk strategies (blue-chip protocols)

- Balanced Bundle: Mix of established and newer protocols

- Growth Bundle: Higher-risk, higher-reward opportunities

Benefits:

- Instant diversification across protocols

- Reduced risk compared to single strategies

- AI-optimized allocation within bundle

- One-click deployment

Option B: Invest in Single Strategies

When to choose single strategies:

- You want full control over allocation

- You have strong conviction in specific protocols

- You're building a custom portfolio

- You want to avoid certain chains or protocols

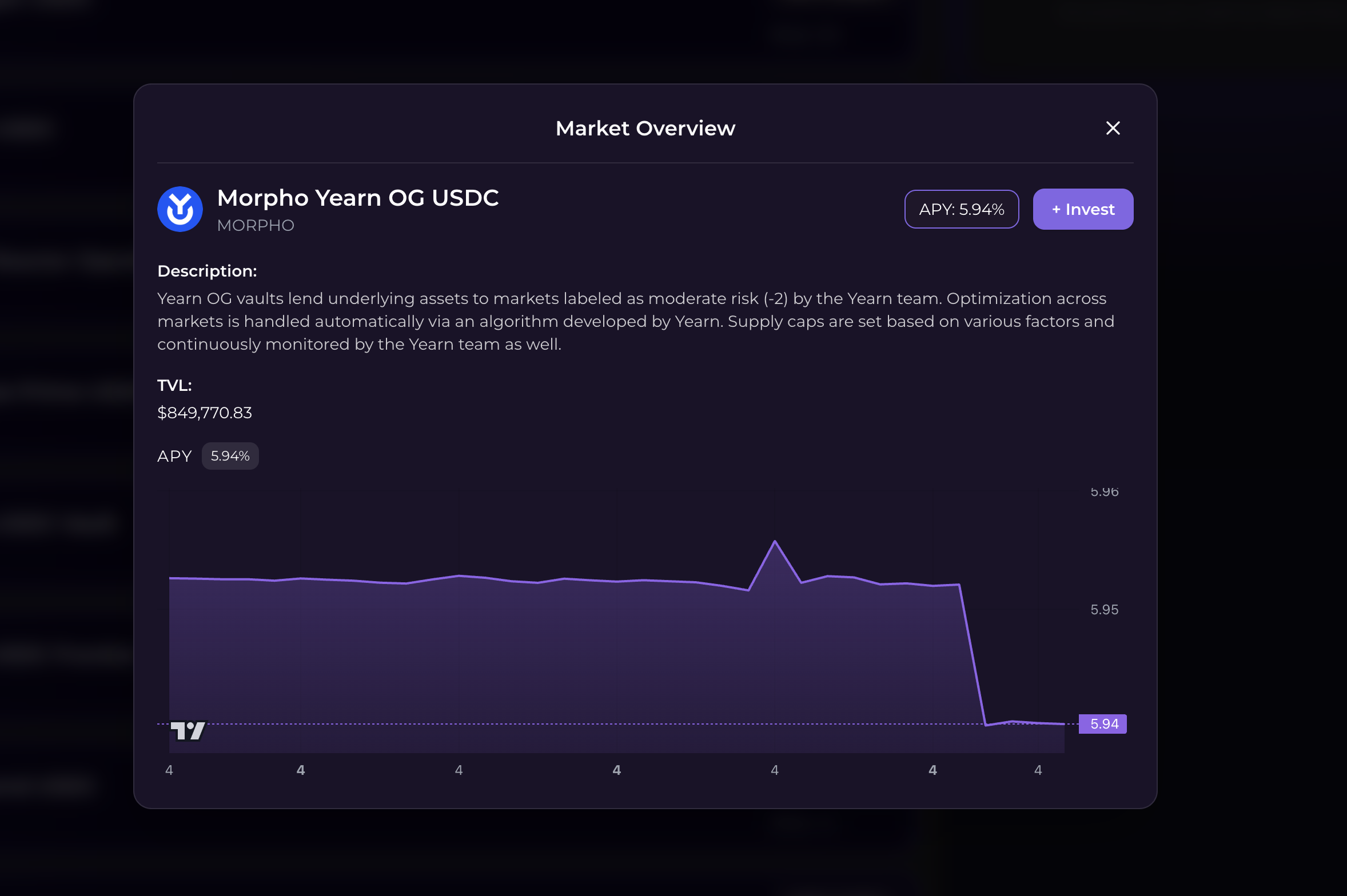

Strategy details:

Each strategy shows:

- Current APY and historical chart

- Protocol name and audit status

- Total Value Locked (TVL)

- Your potential earnings calculator

- Risk rating (A+ to D)

- Minimum deposit amount

Step 7: Allocate Funds

Enter allocation amount:

- Must meet strategy minimum (varies by protocol)

Once confirmed, click "Allocate" to complete the transaction.

Phase 3: Cross-Chain Operations (The Important Part)

Understanding Cross-Chain Deposits

When you allocate to a strategy on another chain (e.g., Aave on Arbitrum), here's what happens:

Step-by-Step Process

1. You initiate (0 seconds)

- Click "Allocate" on the frontend

- Approve transaction in your wallet

- Transaction submitted to Scroll

2. Smart contract sends (10-30 seconds)

- Your USDC leaves your vault on Scroll

- LayerZero bridge message created

- Transaction confirmed on Scroll

3. Pending state (2-5 minutes)

- Your allocation shows as "Processing"

- LayerZero relays message across chains

- You can track progress via LayerZero Scan link

4. Bridge completes (varies by chain)

- Your USDC arrives on destination chain (e.g., Arbitrum)

- Destination vault receives your deposit

- You receive receipt tokens (e.g., aUSDC)

5. Validator confirms (0-60 seconds)

- Our validator detects bridge completion

- Calls your vault to update position

- Validator runs every 60 seconds

6. Position created (instant)

- Your position shows as "Active"

- You now hold receipt tokens tracked in your vault

- Yield begins accruing immediately

What You See During Processing

Pending operation card shows:

- Destination strategy and chain

- Amount deposited

- Estimated completion time (2-5 minutes)

- Current status (Processing → Confirming → Completed)

- LayerZero Scan link for real-time tracking

- Message GUID (for support if needed)

After 40-60 seconds: The validator confirms your deposit and your position becomes active.

Why the Wait?

Cross-chain operations need confirmation from the destination chain.

Without validator confirmation:

- Your vault wouldn't know if bridge succeeded

- You might see a position that doesn't actually exist

- Failed bridges wouldn't trigger refunds

With validator confirmation:

- Your vault only shows real, confirmed positions

- Failed bridges automatically refund to your vault

- You can trust your displayed balance

Same-Chain Deposits (Instant)

If you allocate to a strategy on Scroll (same chain as your vault):

- No bridging needed

- Instant confirmation

- Position active immediately

- Lower gas fees

Troubleshooting Your Journey

"My deposit is stuck in Processing"

Check:

- Click LayerZero Scan link in pending operation

- Verify message status (INFLIGHT, DELIVERED, FAILED)

- If DELIVERED, wait for next validator cycle (60 seconds)

- If FAILED, refund triggers automatically

Timeline:

- Normal: 2-5 minutes

- Congested network: 5-15 minutes

- If stuck >20 minutes: Contact support with message GUID

"I can't withdraw from a position"

Possible causes:

- Position is still "Processing" (wait for Active status)

- Insufficient liquidity in destination protocol (rare)

- You already have a pending withdrawal

Fix:

- Wait for position to become Active

- Try partial withdrawal instead of full

- Check "Pending Operations" for existing withdrawal

Next Steps

Now that you understand the complete vault journey:

- Read Key Concepts for deeper technical understanding

- Join our Telegram for community support and strategy discussions

Ready to start? Launch SynthOS App →